The iPhone 17 is here. Apple’s latest release arrives in four flavors: the standard iPhone 17, a Pro, a Pro Max, and a new iPhone Air edition that replaces the Plus model.

While Apple has successfully added new iPhone users to its base every year, U.S. device sales growth has slowed in recent years, with fewer people racing to upgrade to new generations. Part of that is because recent generations have been seen as offering iterative improvements versus notable leaps in technology, all while carrying heftier price tags. Will the iPhone 17 reverse any of these perceptions or trends?

To get an early read, Start.io analyzed mobile data from millions of U.S. devices, looking at which iPhone models dominate today, both nationally and state by state. The findings offer a glimpse into how Americans upgrade and where Apple still has room to grow.

National iPhone Ownership Trends

When you group together all models within a generation (i.e., the base model, Plus, Pro, Pro Max, and whatever else might have been included in a generational release), the iPhone 14 remains the most widely owned, with 18.91% of the iPhone market, followed closely by the iPhone 16 (18.33%), iPhone 15 (17.57%), and iPhone 13 (17.04%). The rest of the market is divided up among even older models.

But breaking things down by individual models tells a much more nuanced story:

- The standard iPhone 13 leads all devices when it comes to current ownership, with 9.24% penetration.

- The iPhone 14 and iPhone 15 both spread share across multiple sub-models, preventing any one device from topping the list.

- The iPhone 16 generation is unique: The iPhone 16 Pro Max (5.97% on the U.S. iPhone market) outpaces the standard iPhone 16 (4.44%), representing the only generation where a premium model surpasses the base version.

This suggests that Apple’s bet on premium features is resonating with U.S. buyers, at least among the early adopters who move first on a new release.

State-Level Surprises

Start.io’s analysis also reveals state-by-state trends that paint a far more detailed picture of iPhone ownership and upgrade tendencies across the country. Consider:

- The basic iPhone 13 model is king. It ranks as the top model in an impressive 43 states. The iPhone 14 and iPhone 15 consistently slot into second place, reinforcing a generational ladder where newer generations garner significant attention but older ones, particularly basic models, still retain a loyal footprint.

- Legacy models still matter. The iPhone 11 continues to rank among the top five models in 23 states.

Where the iPhone 16 Stands Today

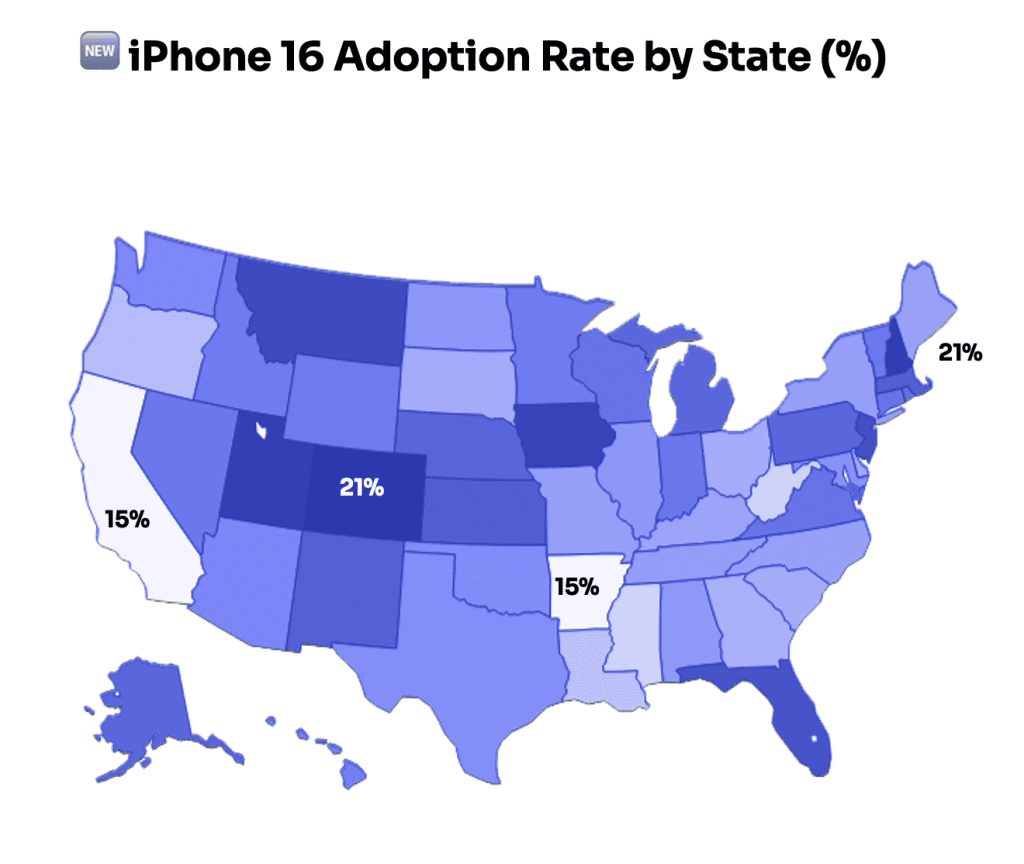

Ownership of the most recent generation, the iPhone 16, varies widely by state. Across all models of the iPhone 16:

- Colorado tops iPhone 16 adoption at 21.3%, positioning it as the most eager state for the latest tech.

- Arkansas lags at 15.4%, underscoring regional differences in how quickly consumers tend to upgrade.

The real question, however, is how many owners of the latest model will be hungry for yet another upgrade.

A Split Market for Premium iPhone Adoption

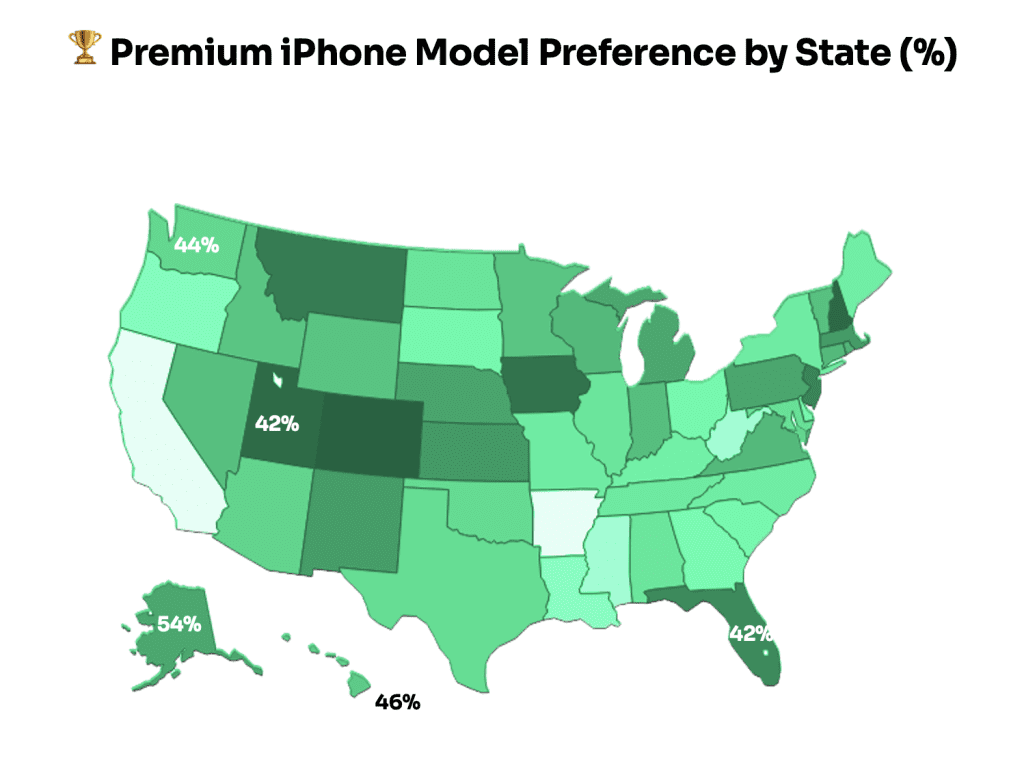

One of the clearest divides in Start.io’s data is between states that gravitate toward Apple’s premium devices (Pro and Pro Max) and those that stick with the base models. While the premium editions have always had loyal followings, adoption levels vary dramatically by region.

- Alaska leads the pack in premium model adoption, with 54% of iPhone users carrying a Pro or Pro Max.

- Mississippi sits at the other extreme, with just 33% of users choosing premium models.

What This Means for the iPhone 17

As the iPhone 17 arrives, with its continued high price point, Apple faces a market where loyalty to older models remains strong, but premium model adoption is significant among newer models. Start.io’s state-by-state analysis shows that the upgrade path is anything but uniform.

Looking ahead, three factors will be worth watching:

- Baseline loyalty vs. early adoption. With the iPhone 13 still entrenched as the top device in most states, Apple will need to convince a large base of satisfied owners to see value in upgrading.

- Premium momentum. The iPhone 16 Pro Max’s lead over the standard model signals a shift in consumer priorities, suggesting that the iPhone 17 Pro and Pro Max could quickly become the dominant devices in their generation. Where will the iPhone Air fit in this mix?

- Regional variation. Wide gaps between states like Alaska and Mississippi in premium adoption, or Colorado and Arkansas in iPhone 16 uptake, highlight how uneven the upgrade curve remains across the U.S. Will these discrepancies continue with the iPhone 17?

If Apple’s bet on a slimmer Air model and stronger Pro lineup pays off, the iPhone 17 could deepen a growing divide in the U.S. market: one where premium devices accelerate growth while older base models hold on longer than ever before. The real story of the iPhone 17 may be how sharply it separates casual buyers from status-driven adopters.