For the first time ever, brands will spend more money buying ads on digital videos this year than on traditional TV, according to a new report from the Interactive Advertising Bureau.

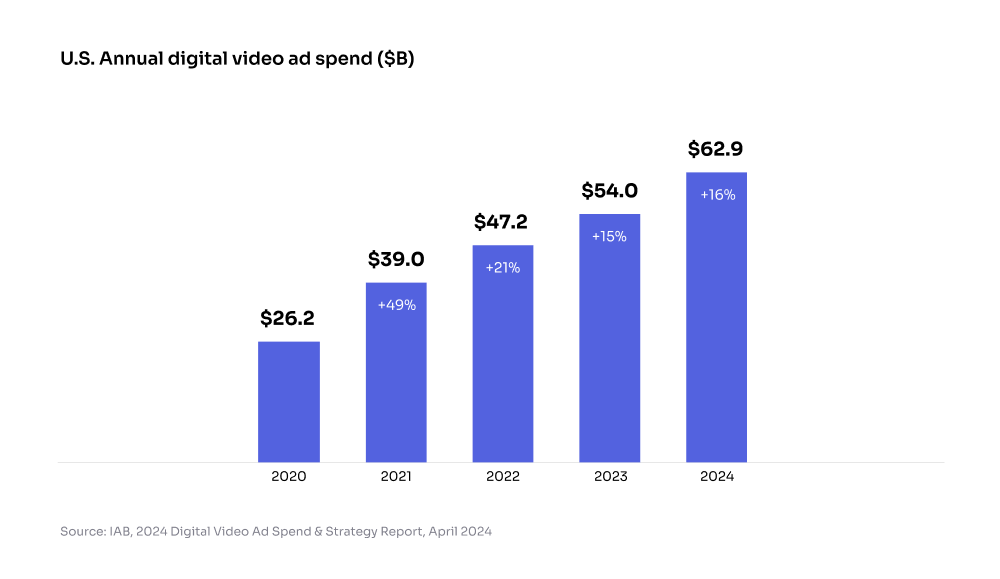

Advertisers are expected to spend $62.9 billion buying digital video ads in 2024, or roughly 52 percent of the total spend going toward all types of video ads, according to analysts at IAB. Traditional TV ads will take the remaining 48 percent of total video ad share, or roughly $58 billion.

The data suggests that advertisers are chasing two things—audience size and audience segmentation.

2024 CTV audience size

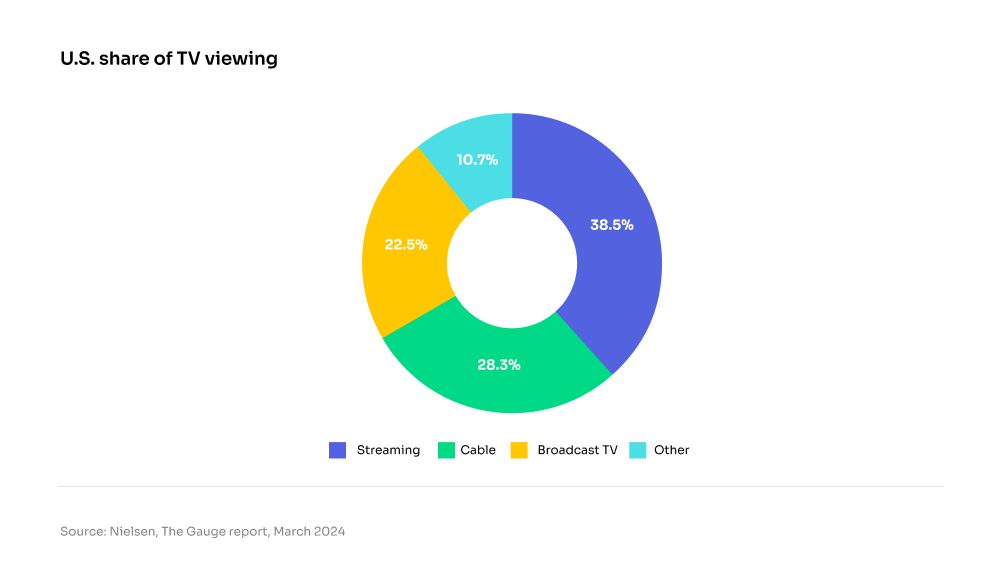

The digital video audience is large, and continues to grow. The average American household now spends around 38.5 percent of TV time per month watching streaming video services like YouTube, Netflix, Hulu, and others, according to a March 2024 report from Nielsen.

Americans spend more time watching streaming video than cable TV (28.3 percent of TV share), broadcast TV (22.5 percent of TV share), and a catch-all category that Nielsen calls “other,” which includes video games and physical media, like DVDs (10.7 percent).

Nearly 7 out of 10 American households now have at least one connected TV (CTV) device as home, according to eMarketer.

Digital video can deliver better audience segmentation than traditional TV, and promises to eventually give advertisers the kind of granular targeting more common with display ads.

CTV ads deliver better audience segmentation

This desire for better-performing audience segmentation appears to be reflected in the IAB’s data.

In a survey of 139 advertisers who plan to increase their spending on CTV ads this year, 40 percent said they plan to increase their CTV ad budgets by shifting existing budget from traditional linear TV. Just 26 percent said they planned to shift budget from audience-based linear TV—an ad targeting method where advertisers buy ads attached to specific TV shows.

2024 CTV advertising trends

Digital video ad spend has doubled since 2020, when brands spent just $26.2 billion on the channel. By 2023, that number crossed $54 billion, and is projected to grow another 16 percent this year, according to analysts at IAB.

Digital videos include CTV, social media videos, and online videos. CTV mostly describes long-form streaming content through apps like Netflix and Amazon Prime, social media video includes video from apps like YouTube and Instagram, and online video includes all other short-form video from online publishers.

Roughly 37 percent of digital video ad spend in 2024 is projected to go to social media video ($23.4 billion), 36 percent will go to CTV ($22.7 billion), and the remaining 27 percent will go toward online video ($16.8 billion), according to analysts at IAB.

Consumer packaged goods companies are currently buying the most digital video ads, with roughly 1 out of 5 dollars ($12.6 billion) spent coming from CPG companies like Procter & Gamble and Pepsi. Retail and technology companies take the second and third spots, respectively.