Start.io slashes CAC for a leading consumer finance app

Brain Finance offers machine learning-based credit solutions to help consumers make smart decisions and improve their financial health. Its flagship product is the next-gen iCash lending app. Over the past 18 months, Start.io assisted the client in generating 28,000 installs of the iCash app across iOS and Android, and the acquisition of over 9,000 new customers who requested a loan or reloan.

Goal

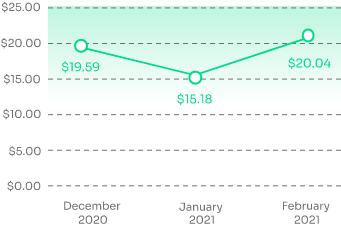

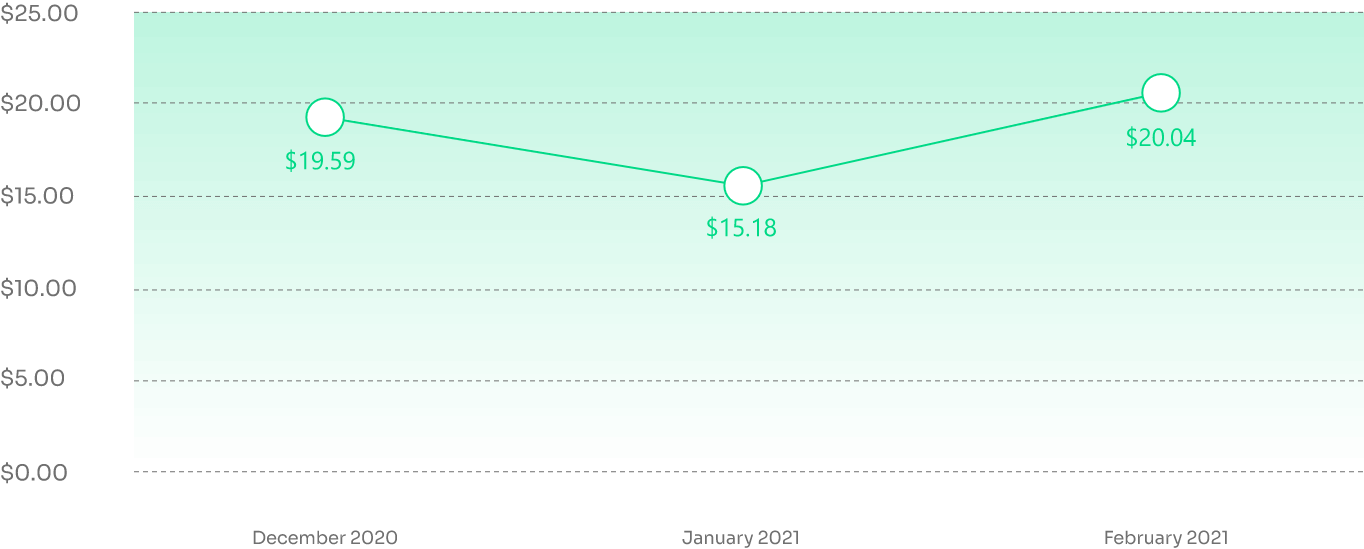

Following the success of iCash‘s app install campaigns, Brain Finance sought the expertise of the Start.io team to drive an increase in loan purchases. The company wanted to retarget users who did not complete the loan purchase process or to get users who previously purchased a loan to apply for reloaning. The client aimed to keep the cost of acquisition per user (CAC) between $20-$30.

new conversions/month

lower avg. CAC than KPI

Outcome

Using a wide range of in-app event data gathered by iCash’s mobile measurement provider, Start.io began the process of deep-dive analysis in order to identify customers with high potential for loan purchasing or reloan. Start.io created 4 unique audience groups that were good candidates for retargeting. With this approach, Start.io succeeded in generating an average of 300 additional loans per month, with an average CAC of $17 per user, well below the benchmark set by iCash.

“With the help of Start.io we were able to acquire new users and achieve a lower cost per loan base which resulted in higher ROI.

The Start.io’s team support is absolutely amazing – they put together a campaign strategy that was based on our goals, helping us grow our business revenue. We are truly happy to have them as a partner”.

Marketing

Re targeting - cost per loan (KPI - $20 < cost per loan > $30)