It’s been dubbed “North America’s weirdest clothing brand.”

It has a customer base so loyal, they are known as “Luluheads.”

It was established more than 30 years after competing athletic brand Nike, but both brands have experienced similar sales growth.

Yes, it’s lululemon athletica (all lowercase on purpose).

Established in 1998, Lululemon is a Canadian athleisure wear company that started out purely for women. It was a brand of its time, a backlash to the women’s power movement of the 80s and 90s, in which women were to work hard and have it all. At the start of the new millennium, a new movement was forming, urging women to restore a healthy work-life balance, and create a more Zen-like life and style. That’s where Lululemon entered the picture.

Lululemon started as a yoga wear brand, at a time when yoga and Eastern spiritual practices were becoming mainstream in the West. The product that launched the Lululemon phenomenon was its invention of the yoga pant, comfortable yet high performance. Lululemon changed the way women wore sports clothing, creating a new niche and filling it with an expanding product range as the niche grew.

The company has since grown into selling athletic wear, lifestyle wear, accessories, personal care products and men’s products.

The company went public in 2007, and was valued at around $1.4 billion in its IPO. By late 2023, investors valued the company at $64 billion. Put another way, if you invested $10,000 in Lululemon stock at IPO, it would have grown to $450,000 by late 2023.

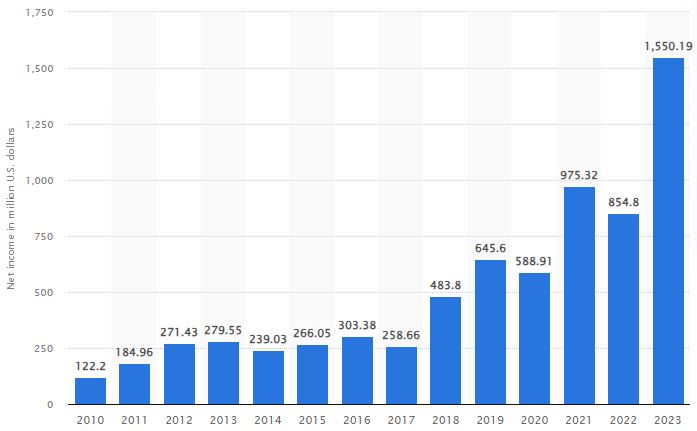

2023 marked Lululemon’s most profitable year yet—selling $9.6 billion worth of products, and turning a profit of $1.55 billion, an all-time high.

Net income of Lululemon worldwide (2010 to 2023)

Source – Statista

In 2023, the National Retail Federation named Lululemon the 6th fastest-growing retail brand in the United States, with annual retail sales growth of 16.7 percent.

All this begs the question: How did this “weird” company with the funny sounding name manage to break open an entirely new market?

Who are the Lululemon target audience that make the brand so successful? What is the Lululemon business model for success? Let’s explore the typical Lululemon customer profile to get the answers.

[add_advertising_contact_form][/add_advertising_contact_form]Who is Lululemon’s target market?

Lululemon customer demographics includes people in their mid-teens to mid thirties, both women and men. They are largely yoga and/or fitness enthusiasts who value work-life balance and a fit and active lifestyle. They are generally affluent, and willing to pay the high prices of Lululemon products. The target market is tech savvy and invested in their self image as health conscious and stylish.

Lululemon market size is largest in the U.S. by far, but the brand is sold globally.

Lululemon target market segmentation and customer profile

Lululemon market segmentation demands a deep dive into four aspects of the target market: demographic, geographic, behavioral and psychographic. Let’s explore Lululemon’s segmentation, targeting and positioning.

Lululemon demographic segmentation

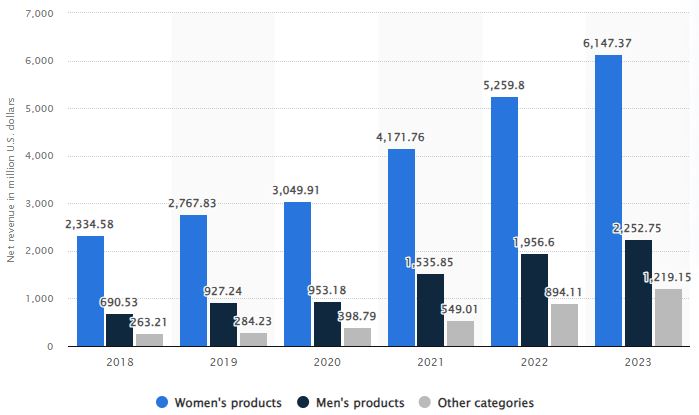

Lululemon has always been more popular with women than men. In 2023, sales of women’s products at Lululemon generated $6.14 billion in net income, compared to $2.2 billion in men’s products.

“Our comprehensive men’s line is a key pillar of our strategic growth plans,” Lululemon wrote in its 2023 annual report. “We believe net revenue from our men’s range is growing as more guests discover the technical rigor and premium quality of our men’s products, and are attracted by our distinctive brand.”

In 2023, the company ran its first TV ad targeting men, featuring Wayne Gretzky, DK Metcalf, and Casey Neistat all wearing the company’s ABC pants.

The company is slowly improving its men-versus-women sales gap. In 2018, women spent $3.38 at Lululemon for every dollar that men spent. By 2023, that gap had narrowed slightly, to $2.73 for every dollar spent by men.

Lululemon sales by market segment

Source – Statista

Lululemon geographic segmentation

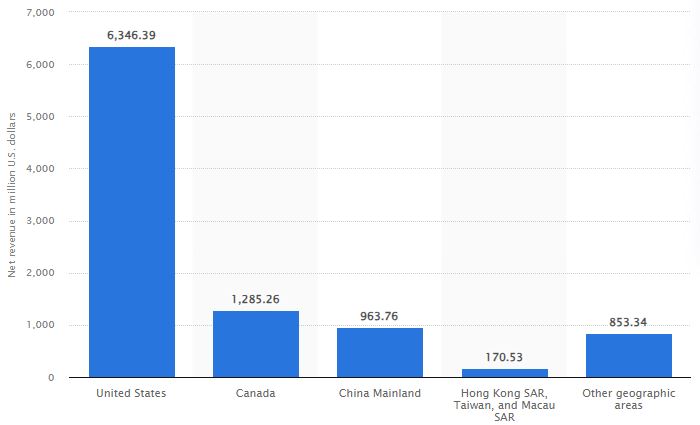

Lululemon is a global brand, although the U.S. and Canadian market is by far the largest, and is enjoying explosive growth. In 2023, sales in the Americas accounted for 79 percent of Lululemon’s net revenue, or $7.63 billion.

Lululemon’s generated $963 million in net revenue in 2023 from mainland China, and $1.02 billion in net revenue from the rest of the world.

Net revenue of Lululemon worldwide by FY2023, by region

Source – Statista

Lululemon ended 2023 with 711 company-operated stores worldwide.

In 2022, there are 574 Lululemon stores worldwide, with the majority in the U.S. (367 stores), followed by mainland China (127 stores), Canada (71 stores), and Australia (33 stores).

Lululemon said it expects that most of its company-operated store openings in 2024 would happen in mainland China in 2024. China remains Lululemon’s fastest-growing market, experiencing a 67 percent growth rate between 2022 and 2023.

In the U.S., Lululemon operates stores, outlets, and pop-up shops in 49 states (currently, there are no Lululemon stores in West Virginia). In 2024, the state with the most stores was California (68 stores), followed by Texas (38 stores), and Florida (34 stores).

In 2024, on a city-by-city level, New York City had the most store locations than any other city (12 stores), followed by Chicago (7 stores), and Houston (6 stores).

Lululemon behavioral segmentation

Lululemon is a premium fitness wear brand, and products are pricey, ranging from $90 to $130 for items such as leggings and bras. Therefore, Lululemon tends to attract middle to upper class customers.

The typical Lululemon target customer is a fitness enthusiast who regularly works out. Yoga lovers are big Lululemon fans, however the customer base partake in several sports, including running, cycling, and training.

Lululemon psychographic segmentation

The Lululemon customer profile is affluent women and men who are career minded and driven, yet at the same time, make healthy living and fitness a top priority. They are high earners, and can afford the uncompromising blend of comfort, quality and style that Lululemon provides.

The Lululemon target audience are often characterized as ‘succeeders’ and ‘aspirers.’ They are passionate about travel, leisure, and work-life balance, not just enjoying them as activities but making them a part of their self-identity.

Lululemon fans are tech savvy, and will typically use fitness tech and apps, such as wearable fitness trackers and at-home fitness class streaming.

Who are Lululemon competitors?

Lululemon remains the third most valuable sporting goods company on the planet, as measured by market cap. In October 2024, Lululemon had a market cap of around $36.5 billion, behind Adidas ($41.6 billion) and Nike ($118.5 billion).

Although a new-ish brand compared to many others, Lululemon outperforms in expected sales growth.

In August 2024, the company said it expects to close its fiscal year with net revenue growth of between 8 and 9 percent.

Meanwhile, Nike in 2024 replaced its CEO and withdrew its 2024 revenue guidance, saying it was expecting weak holiday sales. Previously, it said it expected annual sales to decline in the mid-single digits, Reuters reports.

Nike remains the 800-pound gorilla in the activewear industry, pulling in $51.2 billion in sales in 2023, compared to Lululemon’s $9.6 billion.

Lululemon began as a niche company in women’s yoga wear and later fitness wear. It only more recently expanded to target men and kids. By contrast, the Nike target market has been far broader for far longer.

Other activewear competitors include Adidas and Under Armour.

Adidas is primarily a footwear company—in 2024, roughly 60 percent of Adidas’ sales revenue came from shoe sales, while 40 percent came from apparel, accessories, and gear.

By comparison, Lululemon’s footwear business is much smaller. In 2024, Lululemon’s “other” category—which includes sales of shoes, accessories, and its digital workout classes—accounted for just 13 percent of the company’s revenue.

Under Armour and Lululemon provide an interesting case study in similar activewear brands. Under Armour launched in 1996, while Lululemon launched two years later in 1998.

For years, Under Armour outsold Lululemon. In 2016, Under Armour crossed the $4 billion mark in worldwide sales, at a time when Lululemon was selling just $2.3 billion in sales worldwide.

But Under Armour’s sales have largely plateaued—growing to just $5.7 billion worldwide in 2024, while Lululemon’s sales were expected to cross the $10 billion mark. That departure in fortunes is reflected in investor sentiment—in late 2024, Under Armour’s stock was valued at $3.6 billion, while Lululemon’s was valued at $36.5 billion.

The Under Armour target audience is similar to Lululemon in terms of age demographics. However, Lululemon’s unique positioning as a women-first and lifestyle brand gives it an edge that has seen it exceed the success of Under Armour.

What is Lululemon’s marketing strategy?

Lululemon marketing strategy hinges on a key principle: selling not just products but a lifestyle. Indeed, the company launched a whole new category of clothing – yoga pants – and the lifestyle that goes with it.

The initial Lululemon strategy was hyper-focused on women, but that has changed through the years. More recently the company has begun targeting the male audience, and has applied its edgy and game-changing character to men-focused marketing.

Lululemon sells its products in physical stores located worldwide, as well as DTC via its web store and other third-party online marketplaces. The brand also sells wholesale to fitness clubs and yoga studios, creating brand awareness where the target audience spends their time.

Another Lululemon advertising strategy is to differentiate itself in the crowded athleisure market by shifting the conversation. For example, the brand launched the “Feel” campaign, focusing not on fitness performance but on emotions, such as isolation, anxiety and depression. In this way, Lululemon builds deeper and long-standing connections with customers about the things that matter to their lives, beyond sport and exercise.

What is Lululemon’s brand positioning?

Lululemon is a premium and relatively expensive brand, yet it provides significant returns to customers. Not just in the quality and performance of the product but also in the brand positioning as sassy, different, and ‘out there’ as a game changer.

Indeed, despite the price tags, Lululemon has succeeded in developing a reputation as a cult brand, with a highly devoted customer base willing to pay the price to be a part of a shared community. These brand fans even have a name: “Luluheads.”

For example, Lululemon is famous for its in-store yoga classes, during which display racks are pushed aside in favor of yoga mats, and customers can join in on a yoga session right there on the sales floor. This is all part of Lululemon’s success in selling a lifestyle, a community and a self-image, rather than just fitness wear.

Lululemon can’t compete with the marketing budgets of Nike and Adidas. Rather, it is a “grassroots brand,” with a strong focus on micro-influencers. Lululemon has built an army of powerful brand ambassadors from among the amateur fitness community. For example, its branded hashtag campaign #TheSweatLife generated 1,4000 social media posts from 678 customers, and an estimated $4.6 million EMV.

The Lululemon community-building strategy includes the popular initiative called The Sweat Collective. This is a group of fitness leaders, including athletes, coaches and fitness trainers, who act as advocates for Lululemon, and in exchange receive 25% on all purchases. Even more importantly, members of the Sweat Collective take part in the design process for Lululemon, testing out new products and providing feedback.

This unique crowd-sourcing approach to product development means that the brand can better respond to the market needs. At the same time, Lululemon is building strong relationships with advocates and customers, and enhancing its already successful word-of-mouth marketing approach.

Lululemon controversies

Despite its growth, Lululemon has also experienced its fair share of controversies and mistakes.

In June 2020, at the height of the pandemic, Lululemon spent $500 million to buy the startup Mirror, which made a fitness device that allowed people to work out at home, in front of an internet-connected, full-length mirror.

The hardware cost $1,500 and required a $39-per-month membership. But Mirror—now under the Lululemon Studio brand—didn’t succeed, and Lululemon ended up writing down the value of the acquisition to nearly zero.

In 2024, Lululemon stopped selling the Mirror, and partnered with Peleton to provide new digital workout content.

Lululemon cofounder Chip Wilson made several controversial statements throughout his career, and was forced to step down as CEO in 2008. In 2005, Wilson said Lululemon didn’t make clothing for plus-size women because they required 30 percent more material to produce, meaning the company would have to charge more for them.

“It’s a money loser, for sure,” Wilson said. “I understand their plight, but it’s tough.”

In a 2013 interview with Bloomberg, Wilson said “some women’s bodies just actually don’t work” in Lululemon’s yoga pants. In 2008, he stepped down as CEO, and in 2015, stepped down as chairman.

Despite not being involved in the company, Wilson has continued to criticize its direction, notably in a 2024 interview with Forbes where he said he felt Lululemon should make it clear that “you don’t want certain customers coming in.”

Wilson was replaced by CEO Christine Day, who stepped down in 2013 after it recalled 17 percent of its women’s pants, because they were see-through.

Her successor, CEO Laurent Potdevin stepped down in 2018 after he reportedly had an improper relationship with a colleague. Former Sephora executive Calvin McDonald has led Lululemon since 2018.

Explore more insights

Whether your brand falls into the fitness category, or any of the 500+ niches available at the Consumer Insights and Audiences Hub, understanding your target market is key to creating better campaigns and better targeting. To boost your mobile campaign results, check out all the data insights at the Hub, and get to know your target audience from the mobile data experts at Start.io.

Lululemon FAQs

What makes Lululemon successful?

Lululemon’s success over the past two decades can be largely attributed to its mission to sell a lifestyle rather than products. Although the company focuses heavily on product quality, it invests equally strongly on building a brand that supports the customer’s self-identity, work-life balance goals, and need for a community surrounding health and wellbeing.

How much does Lululemon spend on advertising?

It is unknown exactly how much Lululemon spends on advertising or marketing. However, its advertising strategy is largely based on the activities of brand ambassadors, who interact directly with Lululemon target audiences to teach fitness classes, host events and promote Lululemon products.

How does Lululemon advertise?

Unlike mega brands such as Nike, Lululemon does not invest in expensive celebrity endorsements, rather focusing on grass-roots community building using thousands of micro-influencers. Lululemon relies strongly on word-of-mouth advertising, while also maintaining active UGC campaigns across its social media accounts.