1998: “Don’t get in a car with strangers.”

2008: “Don’t meet people from the internet alone.”

2018: UBER: “Order yourself a stranger from the internet and get in the car with them alone.”

This meme making the rounds strikes a funny and accurate note. Yes, Uber is much more than a ride-sharing app. It has completely disrupted the transport industry, and the way people relate to each other online. Why not catch a ride from a stranger when it is so easy, convenient and fun?

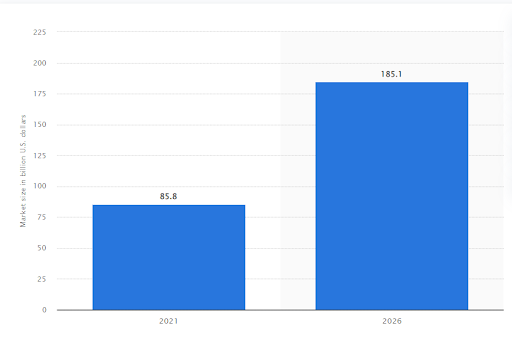

The proof is in the numbers, The ride-sharing market is more popular than ever, and expected to double in size to a value of over $185 billion by 2026.

Source – Statista

A big part of this growth is attributed to Uber, which has become one of the best known brands, not just in ride-sharing, but in the world.

Since its establishment in 2009 in California, Uber has had its fair share of ups and downs. Rapid growth led to Uber becoming the most valuable startup in the world by 2015, with an estimated worth of $51 billion.

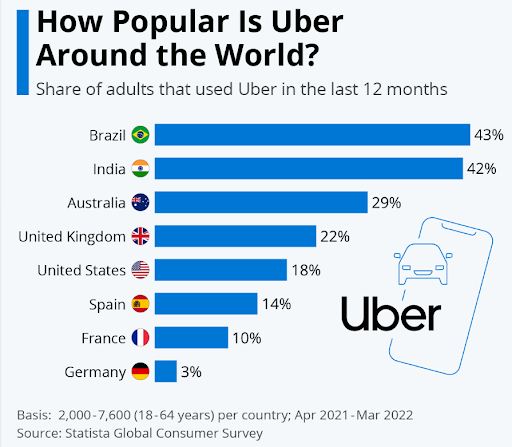

In the US, nearly 1 in 5 people aged 18 to 64 have used Uber in the past 12 months; in Brazil and India, nearly half of all adults have hailed an Uber ride.

Source – Statista

There were plenty of disappointments and PR crises too. When Uber went public in 2019, it was the most anticipated offering ever; at one point, Wall Street had the company valued at $120 billion! However, in reality it proved to be valued at half that, and Uber’s IPO was dubbed a trainwreck.

Add to that allegations of an abusive workplace culture, the infamous Uber Files, and backlash from the taxi industry, plus the global pandemic that saw lockdowns and a massive drop in ride-sharing activity.

Even so, Uber continues to bounce back as an uber-successful brand. In 2021, Uber and its food delivery app Uber Eats had a total of 118 million monthly users worldwide, and generated net revenue of nearly $17.5 billion.

How does Uber do it? Let’s see.

Who is Uber’s target market?

Before delving into an Uber market segmentation, it is important to define two types of Uber target audience:

- Riders, who order ride-sharing services

- Drivers, who provide the rides.

While each part of the Uber target market has its own characteristics, they also overlap in many ways. The Uber target audience of riders is enormous and covers a wide demographic, behavioral and psychographic spectrum.

The driver segment is smaller and has more definitive features. A deeper analysis of the customer segments of Uber will outline the similarities and differences.

Uber Market Segments & Audiences

A thorough Uber analysis of the brand’s market segments and target audience must cover four perspectives: demographics, geographic, behavioral and psychographic segmentation.

Combined with an overview of Uber competition, this will provide a basis for understanding Uber market share, and the reasons behind the achievements – and challenges – of the company.

Uber’s Demographic Segmentation

The Uber target market of riders spans 16 to 65 year olds, although it is most popular among the younger age segment of 16 to 24 years. It includes both males and females. Anyone who might have used a taxi service in the past is a potential Uber user, which includes just about everyone, from young singles to families with small kids and teenagers, all the way to empty nesters, retirees and people who have physical disabilities. 27% of Uber users in the US are among the top 25% income earners, while 44% are in the middle-income range, and 22% are in the low-income range.

There are an estimated 4 to 5 million Uber drivers worldwide, and they tend to be older with more driving experience. Demographics of Uber drivers show that just 6% are under the age of 30. In the US, Uber drivers skew strongly male with just 27% of Uber drivers being female.

Uber’s Geographic Segmentation

As of 2022, Uber operates in most of the world, covering 10,000 cities. This includes all of Europe, North America, Sound America, Australia and New Zealand. Uber is also found in selected countries in Africa and the Middle East.

While Uber operates in both urban and rural areas, it is extremely popular in the world’s largest cities. In fact, 22% of Uber orders come from just 5 major metropolitan areas, including New York City, Los Angeles, Chicago, London and São Paulo. In 2020, Uber bookings in these cities generated revenue of $5.85 billion.

Uber’s Behavioral Segmentation

Uber is the most downloaded travel app for iOS and Android. In 2020, the app recorded 95 million installs. Uber riders are highly loyal customers: 25% of Americans use Uber at least once per month. Among US consumers who ride-share, 63% use Uber exclusively.

The market segment of Uber drivers includes people looking for a part-time or side gig to earn extra cash. In fact, less than 10% of Uber drivers are full time. They typically earn between $15 to $25 an hour, however they can make up to $50 an hour if they plan their location and strategy carefully.

Uber’s Psychographic Segmentation

Uber riders cover a wide income range, from frugal students to middle income employees and high income professionals.Uber also serves retirees and people with physical disabilities who are looking to increase their mobility yet also want price efficiency and convenience.

Uber riders can be characterized as easygoing and determined. They turn to Uber for ease of use in ordering lifts, and the instant, reliable service.

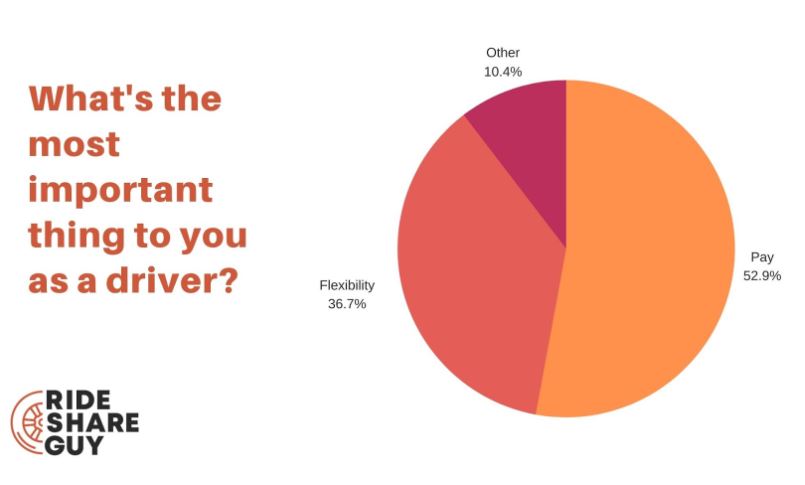

Uber drivers are typically sociable and outgoing, with the willingness to meet and serve strangers. They have adventurous and entrepreneurial personalities. A survey of Uber drivers showed that the pay they receive is most important, followed by the flexibility that the job allows.

Source: Rideshare Guy

Who are Uber’s competitors?

In the ride-sharing market, the main Uber competitors are Lyft and DiDi.

Uber is a global company, while Lyft operates only in the US and Canada, making it the most significant among Uber competitors in the USA. In 2021, Lyft revenue stood at $3.2 billion, far less than Uber’s $17.5 billion. Even so, Lyft is a strong competitor in the North American market, gaining some of Uber market share in recent years. Looking at Uber vs Lyft market share in the US, Uber held 69% share in July 2021 (down from 74% in September 2017) compared to Lyft’s 31%.

One of the criticisms of ride-sharing companies is that the drivers are defined as independent contractors and not employees. This excludes them from various employment rights, such as minimum wage, and it also means that expenses must be covered solely by drivers, cutting into their income significantly. Lyft appears to do slightly better in terms of driver satisfaction than Uber; more than 52% of Lyft drivers said they were satisfied with their conditions in 2019, compared to around 45% of Uber drivers.

For riders, a big advantage of Uber is the cheaper cost. The average Uber trip costs $20, while the average Lyft ride comes in at $27.

DiDi absorbed China’s Uber business in 2016, and has since become Uber’s chief competitor in that region. DiDi is the largest ride-share company in China with 550 million users. Although focused mainly on China, DiDi operates in 15 other regions, including South America, Russia, Australia, South Africa and Japan. Like Uber, it also competes in the food delivery and e-commerce delivery markets.

In 2019, Uber had a global market share of 37.2%, and DiDi came in second place, with 32.4%. Together, Uber and DiDi make up the majority of ride-sharing services worldwide.

In 2014, Uber expanded into the food delivery market with the launch of Uber Eats as a standalone service and app. In 2020, Uber Eats acquired competitor Postmates for $2.65 billion, cementing its status as a tough contender. During the pandemic, there was a massive surge in demand for food delivery apps, putting Uber Eats in direct competition with the GrubHub and DoorDash target market. In 2021, Uber Eats revenue was $8.3 billion, an increase of 72% from the previous year.

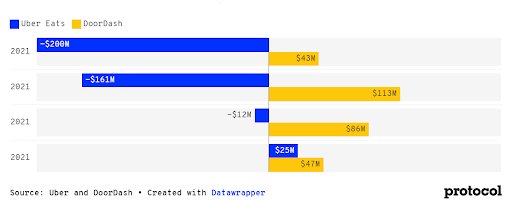

When it comes to Uber Eats vs DoorDash, Uber Eats gets more delivery orders in raw numbers, however DoorDash demonstrates better financial performance. While DoorDash was profitable throughout 2021, Uber Eats showed a profit just in Q4.

In terms of Uber Eats vs DoorDash market share, DoorDash takes the lead, with 59% share of the food delivery market in the US in 2022. Uber Eats market share comes in far second at 24%.

What is Uber’s Marketing Strategy?

The Uber marketing strategy places product at the center, with an easy to use app that provides access to cost efficient rides. Moreover, the ability of Uber’s data-driven technology to provide complete transparency, tracking of journeys, and a rating system for riders has succeeded in disrupting the traditional taxi market.

Uber’s service offering is wide, with a range of ride options for all customer needs. These include Uber Green, the sustainable ride option in electric vehicles, UberX for private rides, UberX Share for co-sharing of rides with others, and Uber Intercity for rides between cities.

An Uber marketing analysis must also mention the company’s strategic expansion with Uber Eats. While Uber’s ride-share business suffered immensely during COVID, Uber Eats services doubled, providing much needed relief for the company.

Loyalty has always been a key strategy for Uber marketing, offering incentives to customers to encourage retention. Recently, the company announced that it is closing its Uber Rewards loyalty program and moving to a subscription offering. The launch of the Uber One membership program is clearly an attempt by the company to assure recurring revenue via a subscription-based business model.

Word-of-mouth marketing has been a crucial aspect of Uber’s rapid expansion and success. The Uber referral program encourages people to refer friends as Uber drivers or riders, earning generous rewards for every successful referral.

Brand collaborations are a staple of Uber advertising strategy. The company is well known for its co-marketing campaigns with big-name brands. For instance, Uber famously collaborated with Spotify enabling riders to listen to their favorite Spotify playlists on their ride. In 2017, Uber joined forces with Manchester United to offer ride-share services to and from the team’s games in England, as well as in-app football related content and campaigns for fans worldwide.

During the pandemic, Dettol and Uber paired up to promote health and safety during ride-shares. Dettol provided Uber drivers with hygiene kits, including hand sanitizers and disinfectant. As business travel returns to normal after the pandemic, Uber and Deem, a corporate travel booking company, have collaborated to enable Uber for Business bookings to be made directly from within Deem’s Etta platform.

Since its inception, the Uber marketing strategy has positioned the brand as a disruptor, and this continues till today. A recent Uber commercial claims the company offers riders ‘new ways to move’, while giving drivers ‘new ways to work’.

https://www.youtube.com/watch?v=eOQkwynU9-A

The Uber image is of a brand that takes a stand and is not afraid of failure. This tenacity has been instrumental in supporting the company not just in its successes but also during several serious PR crises that have plagued the company over the years.

Uber Eats Users in Miami

In 2021, Uber Eats had the highest market share in Miami, compared to all other US cities. 55% of the food delivery services in Miami were from Uber Eats.

Indeed, mobile data from the Start.io network shows an audience size of close to 40,000 Uber Eats users in Miami, nearly 10% of the city’s population.

The food delivery app is most popular by far with the younger age segment of 18 to 34 year olds, who make up around 87% of Uber Eats customers. A much higher percentage of males use Uber Eats in Miami: 66% male to 34% female. The lower income bracket has high representation with nearly 40% of Uber Eats users in Miami earning annual household income of $25,000 or less.

Looking for data like this to inform your mobile campaigns? Interested to learn more about your target market? Visit the Consumer Insights and Audiences Hub and explore 500+ consumer segments and locations worldwide.

With the help of Start.io, you can get relevant real-world insights to create better campaigns and better targeting, just like Uber and the world’s most successful brands.

Uber FAQs

What age group uses Uber the most?

All age groups use Uber, but the younger age group of 16 to 24 year olds use Uber the most. 37% of people in that age group use Uber, followed by 28% of 25 to 34 year olds.

What is Uber's main goal?

Uber’s main goal differs for its two key target markets. For Uber riders, the company’s goal is to increase the number of ride bookings and maximize revenue. The company is soon launching a new subscription based membership program called Uber One, designed to encourage customer retention and assure recurring revenue.

For the target market of Uber drivers, the company aims to add more drivers in strategic locations to boost service coverage and increase revenue potential.

What makes Uber so successful?

The success of Uber can be attributed to the brand’s tenacious character, which has led to being a major disruptor of the global taxi market. It is also due to the user-friendly and convenient ride booking app that uses real-time data to support tracking, feedback and an optimal customer experience.

Uber Eats, the brand’s food delivery service, has played an important role during the pandemic, enabling the company to better survive the massive drop in ride-sharing by substituting with increased demand for food delivery services.