SaaS (Software as a service) is one of the fastest growing tech sectors.

From 2021 to 2022, the number of end users of SaaS products was forecast to increase by more than 20%. The SaaS market is currently estimated at a value of $152 billion, and will reach $208 billion by 2023.

The brand that started it all is Salesforce.

In 1999, Salesforce founder Marc Benioff had a vision of a better, more efficient way for enterprises to use software. He believed that on-premise software was cumbersome. It had to be bought and installed, and updated every time a new version or feature was available. The concept of cloud software that could be accessed anywhere and instantly updated, as an ongoing service subscription rather than an expensive one-time purchase, was something no one believed was really possible. Now, thanks to high speed internet and Benioff’s vision, most of what we do online happens in the cloud.

This is the most important asset of the Salesforce brand: a reputation as a trailblazer in the cloud computing niche. Salesforce didn’t just revolutionize cloud technology; it completely altered the relationship between enterprises and software companies.

Launched in 2000, Salesforce’s flagship product – and the heart of the brand’s success – is its SaaS CRM (Customer Relationship Management) software, enabling large companies to manage and optimize their sales, marketing and customer data in the cloud. And Salesforce has never looked back.

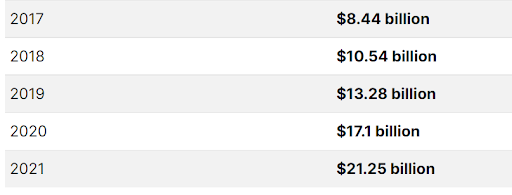

In 2022, Salesforce annual revenue continued to grow steadily, reaching a record high $26.49 billion.

Salesforce is the undisputed leader in the SaaS CRM industry, and among the top 5 global cloud vendors in terms of revenue, together with brands such as Microsoft Azure, Amazon Web Services, and Google Cloud.

Let’s take a look at what drives this awesome brand strength and performance, and gain an understanding of who is the target market of Salesaforce.

Who is Salesforce Target Market?

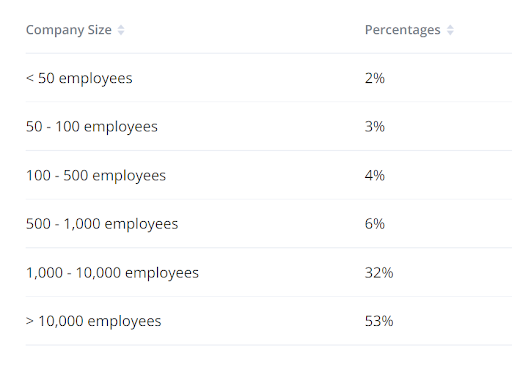

The Salesforce target market is mainly large businesses and enterprises. The vast majority of Salesforce customers are companies with over 1000 employees.

Companies that use Salesforce are located worldwide, however the largest market is the United States. Salesforce developers and architects are highly educated and earn a high income. They are typically career minded and aspirational, strongly connecting to the Salesforce brand image as a ‘trailblazer.’

Salesforce Target Market Segmentation

A Salesforce market segmentation must take into account four perspectives: demographics, geographics, behavioral and psychographic segmentation. Let’s explore them all to gain a deeper understanding of the Salesforce target market.

Salesforce Demographic Segmentation

The professionals who use Salesforce and make up the typical Salesforce customer are Salesforce developers. Just over 72% of Salesforce developers are men, and the remaining nearly 28% are women.

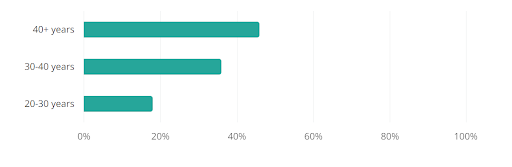

The average age of Salesforce developers is over 40 years, making up 46% of the segment. The next largest age segment of Salesforce target users are between 30 and 40 years of age.

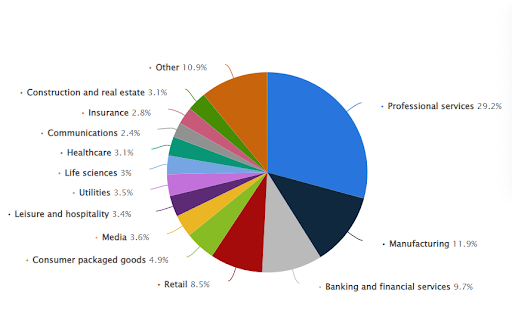

Nearly a third of Salesforce customers are from the professional services industry. Companies in the manufacturing, financial services and banking industries are also strong users of Salesforce. Other customers who rely on Salesforce come from the retail, CPG and media industries.

Source – Statista

Salesforce Geographic Segmentation

The largest target market of Salesforce is the United States, which has around half of Salesforce CRM customers in 2022.

Salesforce target markets are located globally, with the second largest number of customers in the UK, followed by Canada, Germany and India.

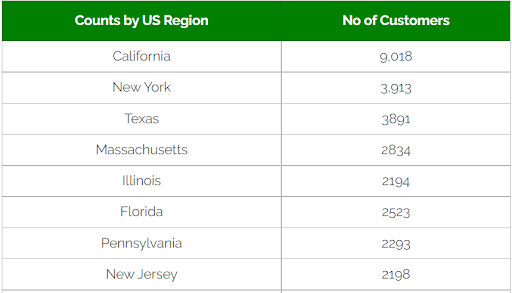

The biggest Salesforce target audience in the US by far is California, where over 9000 Salesforce customers are located. New York and Texas lag in second and third place, with less than half that number.

Europe generates the second highest amount of revenue for Salesforce after the US, at around $4.5 billion in 2021, or just over 21% of total revenue. The APAC region generates nearly 10% of Salesforce revenue, just over $2 billion in 2021.

Salesforce Behavioral Segmentation

The typical Salesforce customer is mostly interested in subscription-based purchases of cloud services, software licenses and technical and customer support.

In a breakdown of Salesforce customers by job title, it is evident that Salesforce developers are the largest segment, making up 27% of all customers, with Salesforce architects coming in second at 22%. Other job titles that make up the Salesforce target market are Administrators, Project Managers, Consultants, and several others.

Salesforce Psychographic Segmentation

Salesforce customers are highly educated and professional. They are typically employed in large enterprise companies. Salesforce developers who have a PhD have the highest annual income, compared to around $95,000 for those with a Bachelor’s degree.

The Salesforce target market is tech savvy and driven, and very career focused. Their personalities are described as ‘aspirers’ and ‘succeeders’.

Salesforce also tends to attract customers that are ’trailblazers’. They take pride in using a game-changing product, and continually seek out opportunities to leverage it in order to advance their work performance and even their careers.

Who are Salesforce competitors?

Salesforce is the world’s leading provider of CRM software. In 2021, Salesforce market share stood at 23.8%. The next closest Salesforce competitors are SAP, Microsoft, and Oracle, who lag far behind with around 5% market share each.

When asking who are Salesrforce competitors, it’s clear that some of the biggest names in tech are among them. However, they are only truly competing in the CRM niche.

- Microsoft Dynamics 365, for example, is Microsoft’s CRM cloud product, and although not a close competitor to Salesforce, is performing quite well. By the end of March 2022, revenue from Dynamic’s products and services rose by 27% in the previous nine months, compared to the same period last year.

- For Oracle, its cloud services and license support department generated more than $30 billion in 2022, making it the most profitable part of the business. The total revenue for Oracle in that period was more than $40 billion.

- More specifically, the Oracle CRM has nearly 9000 customers, generating revenue of around $1.5 billion, representing just over 7% market share.

- Hubspot is another brand among competitors of Salesforce, however, it does not come close in the CRM space. Salesforce vs Hubspot shows that Hubspot succeeds in the narrower category of marketing automation, holding over 31% market share with a focus on small to medium businesses. Salesforce, however, is the definite CRM and marketing automation software of choice for large enterprises.

From 2016 to 2020, Salesforce consistently remained the CRM market leader, with market share ranging from 16.8% to 19.6%. SAP and Oracle continued to compete in second place. Microsoft and Adobe are later competitors in the CRM space, entering the market in around 2017.

Which companies use Salesforce?

Large enterprises are the main type of companies that use Salesforce. This is clear in an analysis of the sizes of companies that hire Salesforce developers. Fully 53% have more than 10,000 employees. 85% of companies that employ Salesforce developers have more than 1000 employees.

How many companies use Salesforce? Currently, there are more than 150,000 companies that use Salesforce in all key verticals, including some of the top global brands and Fortune500 companies. Examples include Adidas, Spotify, Cisco, Hershey’s and Macy’s.

Among the largest customers of Salesforce are Amazon Web Services, American Express, Toyota, and L’Oreal.

Does Netflix use Salesforce?

It is unclear whether Netflix uses Salesforce for its customer relationship management activities, as the company does not publicly provide this information. Interestingly though, Salesforce brand strategy is aiming to turn the company into the Netflix of business, entering the streaming market with Salesforce+. The idea is to leverage the Netflix model to provide business related digital content on-demand, targeting businesspeople and professionals, and boosting the brand profile of Salesforce at the same time.

What is Salesforce Marketing Strategy?

The Salesforce marketing strategy has always been about trailblazing. When the company launched over 20 years ago, founder Marc Benioff claimed it was the “end of software”, in a dramatic protest-style performance in Silicon Valley. He paid actors to hold up “anti-software” signs outside a conference run by a competitor in the CRM software space. Although this drew attention, it was still the earliest days of SaaS. However, the trailblazing Salesforce strategy continued, and it has undoubtedly fueled the success of the company till today.

One of the ways that Salesforce maintains its reputation as a groundbreaker is with its annual Dreamforce events, showcasing new innovations and products, building an engaged community of developers and users, while continuing to plug the company vision and identity as a leader.

The growth mentality of Salesforce marketing cloud strategy is clear in its approach to acquisitions. By 2021, Salesforce had acquired 69 companies, significantly expanding its product and ability to innovate. Notable acquisitions include BI and data analytics platform Tableau, and the recent purchase of Slack, the workplace communication platform.

The success of Salesforce is also attributed to strategic partnerships that enable the company to develop new and better solutions. Salesforce has partnered with technology leaders such as IBM and Dell, and even with rival competitors such as Microsoft, to leverage joint technology initiatives, boost the product and customer experience, and facilitate market growth.

In 2022, Salesforce R&D spend reached $4.47 billion, an increase of nearly $4 billion since 2015. This increasing commitment to research and development is also key to supporting the trailblazing and innovating character of the company.

While Salesforce marketing strategy deeply focuses on product, technology and innovation, the company does not shy from traditional marketing and advertising tactics. In 2022, marketing and sales spend at Salesforce reached $11.85 billion, an increase of nearly $9 billion since 2015.

Salesforce is active on social media, particularly LinkedIn, widely known as the best platform for B2B and enterprise marketing. Salesforce has over 4 million followers on LinkedIn, compared to less than a million on Facebook. Interestingly, Salesforce even has a TikTok account, although the following is so far small, with over 4000 followers.

Salesforce also has an active YouTube channel, with over 250,000 subscribers. The company posts a large amount of video content, including explainer videos about how to use the Salesforce platform, case studies, product updates, demos, and more. The “Salesforce on Salesforce playlist” even gives insight into the CRM marketing tactics that Salesforce uses on its own customers, including ABM marketing and B2B digital outreach.

https://www.youtube.com/watch?v=8L80YLsCIK0

Salesforce also devotes budget to high-end production and costly advertising spots, such as its 2022 Super Bowl ad starring Matthew McConaughey. The commercial is based on the company’s most recent branding theme, “TeamEarth”. TeamEarth brings business and technology back down to earth and back to what matters most – people, customers, success, sustainability, diversity and equality.

Although the techy-est of tech companies, Salesforce is attempting to trailblaze again, moving away from the metaverse, and getting out the message that not everything is technology. In its “Tech & Trust” campaign, Salesforce is supporting the safety and wellness of the 240 US Paralympians, and championing inclusivity and empowerment of people via technology.

The success of Salesforce is truly unique, but with the right data and insights about your target audience, you can craft mobile campaigns that resonate and engage customers. Visit the Consumer Insights & Audiences Hub, and explore 500+ niches and locations, from B2B to Dining and Sports, so you can trailblaze with better campaigns and better targeting.

Salesforce FAQs

How many customers does Salesforce have?

Salesforce currently has over 150,000 customers worldwide.

What industry does Salesforce target?

Salesforce largely targets enterprise companies, including both B2B and B2C companies, across all major verticals. The largest vertical that uses Salesforce CRM is professional services, followed by manufacturing, financial services, banking and retail.

What makes Salesforce so unique?

The key to Salesforce’s success over 20 years is a trailblazing approach to cloud technology that disrupts the ways that companies use CRM software. To achieve this, Salesforce focuses very heavily on innovation, via strategic partnerships, R&D and acquisitions, continually expanding the tech capabilities of the product.

At the same time, the brand never wavers from its core identity as a pioneer, building a community of empowered employees and customers to maintain Salesforce’s position as number one in the CRM industry.

Additional Sources