Over the past six decades, Nike has built itself into one of the world’s most iconic brands, instantly recognized by its ‘Just Do It’ slogan and trademarked ‘swoosh’ logo. The company remains the world’s largest sportswear brand, pulling in more than double the annual revenue than its next-closest competitor, Adidas.

Nike remains dominant through innovative product development and marketing tactics, emotion-based messaging, celebrity endorsement deals, and sports sponsorships.

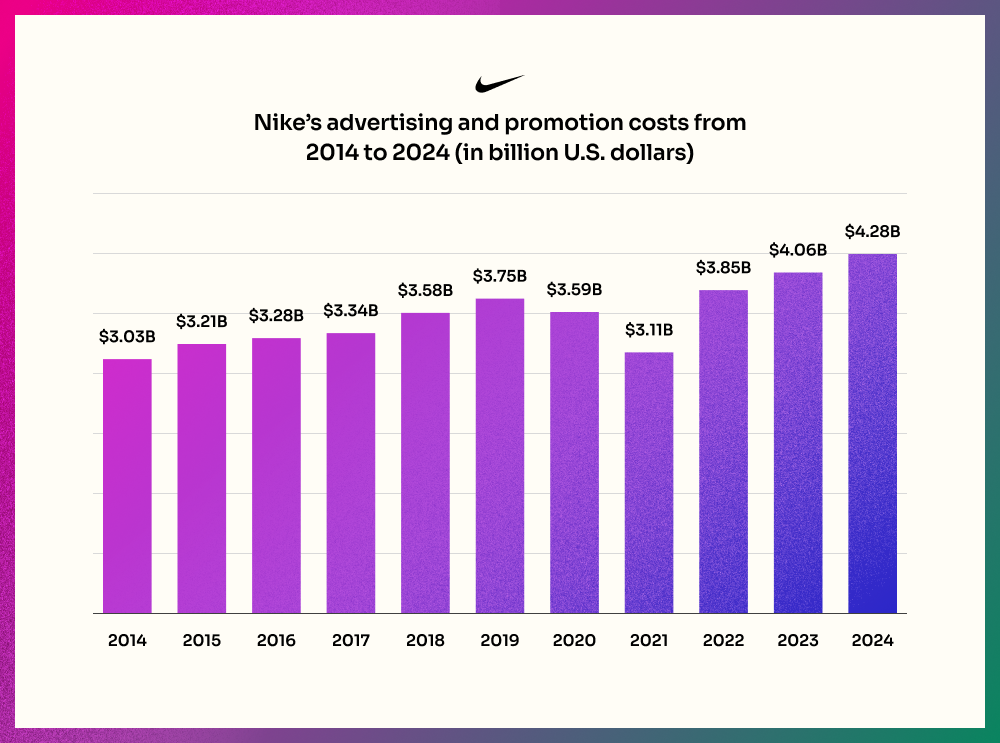

The brand also invests heavily in advertising. Since 2014, Nike has spent more than $3 billion per year on marketing and advertising, a catch-all category the company calls “demand creation.” In FY2024, Nike spent nearly $4.3 billion on marketing and advertising.

Source – Statista

By comparison, Adidas Group spent €2.5 billion Euros (roughly $2.7 billion USD) on marketing and point-of-sale expenses in FY2023.

Most of Nike’s ads don’t explicitly focus on a product; the Nike target audience responds most effectively to emotion-based advertising. This strategy helps create a brand image that reflects the aspirations of Nike customers, increase brand loyalty, brand engagement, and sales.

So, who is Nike’s target market? What are their aspirations, and how has the brand succeeded in building such a loyal fan base? Let’s begin with a Nike customer analysis and find out.

Who is the target market for Nike?

Nike sells its products worldwide, and has built products for every age and nearly every major sport. While Nike’s advertising focuses on athletes and weekend warriors, a “large percentage” of its products are worn for casual and leisure purposes, Nike said in its FY2023 annual report.

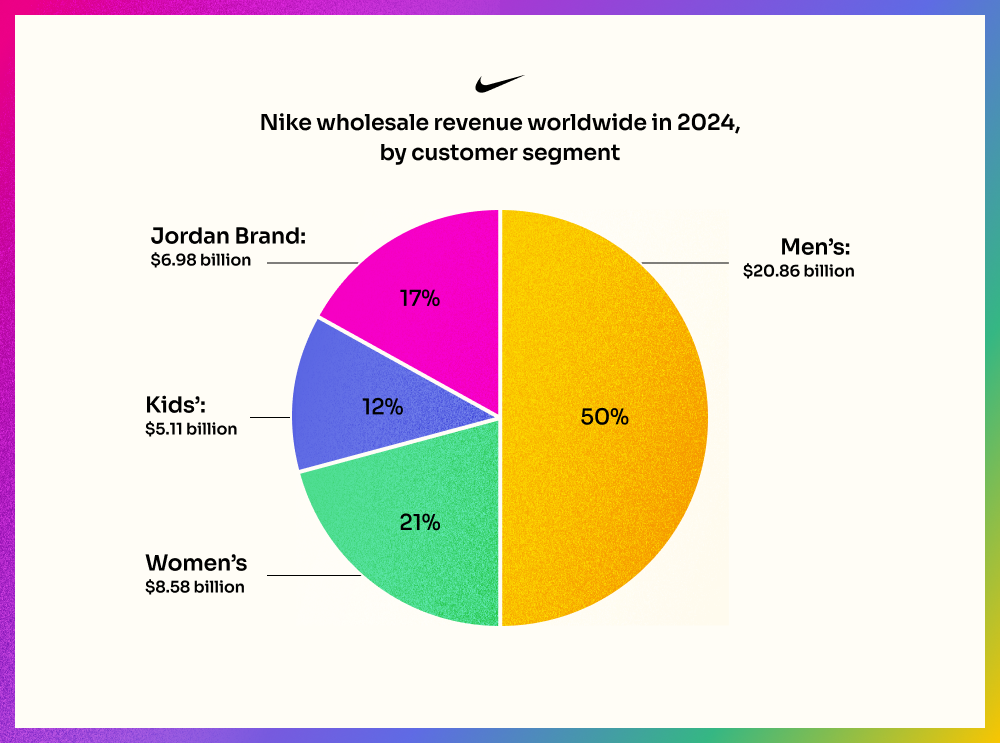

Men’s products outsell every other product category by a wide margin. In FY2024, men’s products made up a little over half of total wholesale revenue worldwide.

Source – Statista

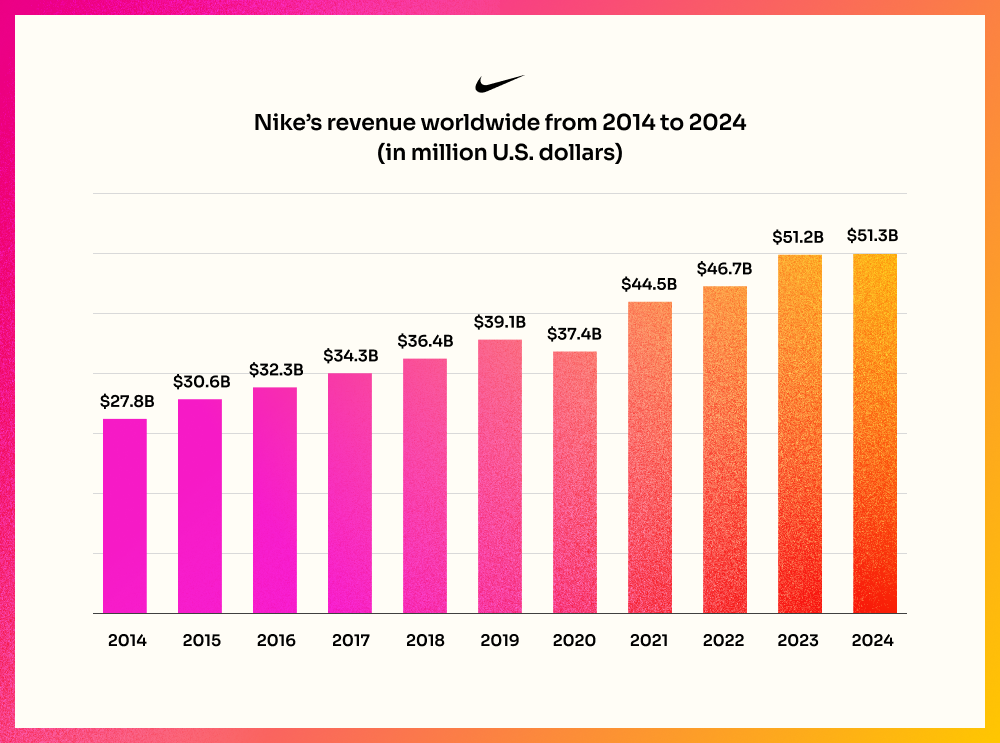

Nike positions itself as a brand for athletes but pulls every consumer into the fold with its fundamental pitch: if you have a body, you are an athlete. This has led to Nike’s outstanding financial success, generating more than $51 billion in worldwide sales in FY2024.

Source – Statista

Nike Target Market Segmentation and Marketing

The key component for any advertising or marketing strategy is a thorough customer segmentation, including demographic, geographic, behavioral, and psychographic attributes. Let’s explore the Nike target market profile from each of these viewpoints.

-

Nike Demographic Segmentation

Nike demographics include a wide range of users, aged roughly from 15 to 45 years. By spanning the generations, Nike taps middle-aged consumers who have disposable income and develops its relationship with younger audiences to ensure future growth and build life-long brand enthusiasts.

The company targets both male and female consumers, however, it continues to make significant investments in its women’s line, focusing on leggings, sports bras and ‘athleisure.’

Nike also strongly targets the youth demographic, noted as the favorite footwear and apparel brand for teens in 2024 in the US, according to analysts at Piper Sandler.

-

Nike Geographic Segmentation

The target market for Nike is located worldwide, mostly in urban centers. Nike consistently generates more revenue from North America than any other region.

In 2024:

- 5%, or $21.4 billion, of Nike’s revenue came from North America

- 6%, or $13.6 billion, of Nike’s revenue came from Europe

- 2%, or $7.5 billion, of Nike’s revenue came from Greater China

- 6%, or $6.7 billion, of Nike’s revenue came from Latin America and the Asia-Pacific region

-

Nike Behavioral Segmentation

The Nike target audience tends to be from the higher-income socio-economic group, reflected in the premium brand image and pricing of Nike products. The average Nike customer is a sports enthusiast, interested in leading an active and healthy lifestyle.

Besides the sporty behavioral traits of the Nike audience, they are also image-conscious and tech savvy, looking to be ahead of the trends and up-to-date with the latest in fitness fashion and footwear technology.

-

Nike Psychographic Segmentation

As part of a strategy to widen its target market, Nike often focuses on breakout psychographic segments. These include ‘weekend runners’, who enjoy keeping fit on weekends and even training for a half marathon, and ‘style shoppers’, 20-something women who want to wear the latest sports fashion trends before, during and after workouts.

All Nike consumer segments are made up of ‘aspirers’ and ‘succeeders’, people who are motivated to be fit and stay on trend.

-

Nike Marketing Strategy

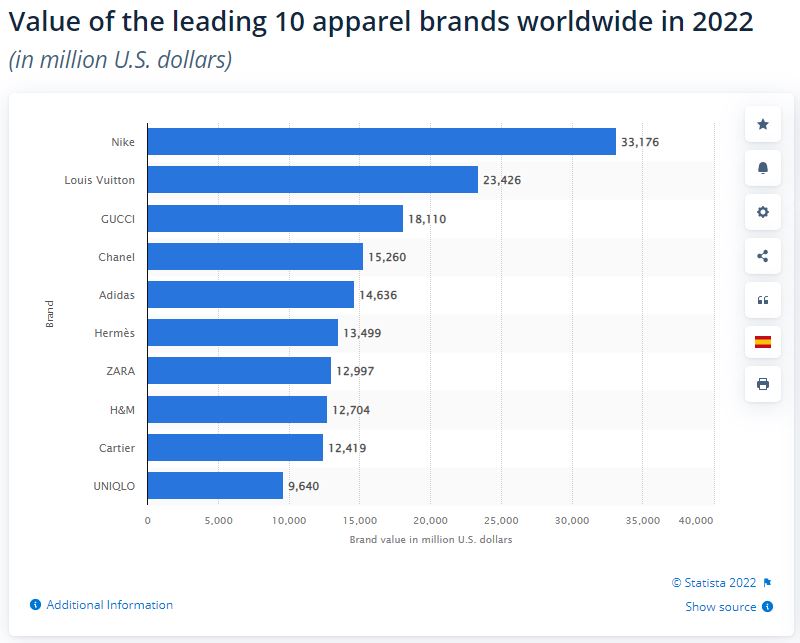

Beyond the sports clothing and footwear market, Nike is estimated to be the world’s most valuable apparel brand, with a brand value of $42.5 billion in 2023, according to the FashionUnited Index of Most Recognized Fashion Brands.

When considering how to create a successful marketing strategy, look no further than Nike.

The STP of Nike informs a wide-ranging set of marketing goals and objectives. For example, Nike leverages behavioral segmentation to build brand affinity and loyalty with consumers.

This can be seen in their personalized email and social media campaigns. When people engage with and show ongoing interest in the brand on any platform, Nike retargets them on other channels.

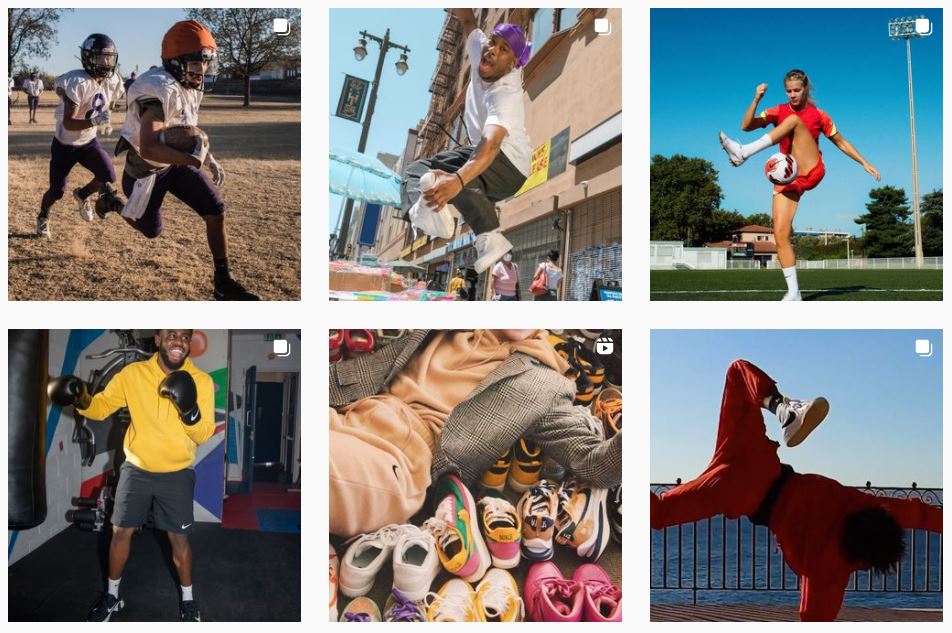

Here’s a look at how they connect with the two most dominant age groups (18-24 and 25-34) on Instagram:

Although Nike targets a global audience, it uses geographic segmentation for its product lines and marketing campaigns, adapting for local cultural and weather trends that impact consumer behavior. For example, the brand’s warmest winter items aren’t available in countries with more moderate temperatures.

Another example of how the brand connects with different geographic regions can be seen in the athletes featured in ad campaigns. In the US, for example, the Nike “Stopocalypse” ad features American sportspeople and celebrities, such as Kobe Bryant, Kevin Hart and Simone Biles:

In the UK, the well-received ‘Nothing Beats a Londoner’ campaign targeted the hyper-local London youth market, featuring upcoming London athletes and real-life citizens.

The campaign combined user-generated social media content, local events, swag and more, to encourage young audiences to become involved in sports and realize their potential.

Product innovation and a show-stopping approach to marketing sets the Nike brand apart from the competition in all regions. Check out the remarkable OOH 3D billboard promoting Nike Air Max in Japan:

The Nike company markets at a grass-roots level with a wide range of corporate responsibility programs and charitable activities. In FY2023, Nike contributed $142.7 million toward community investment, including women’s empowerment, sustainability and diversity initiatives.

Sports Enthusiasts in United States

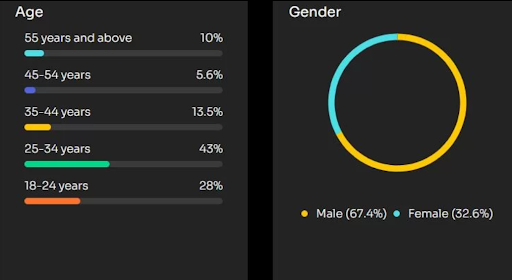

US-based consumers who fall into the Sports Enthusiasts category share many of the traits of the Nike target market. Like Nike, the demographics represent both sexes, with men outranking women 67% to 33%.

The Nike target market age group is also similar to the Sports Enthusiasts segment, of which 84.5% of consumers are between 18 and 44.

Although Nike hasn’t released data around its device targeting segmentation, Start.io insights reveal that among consumers identified as Sports or Running Enthusiasts, there is an overwhelming preference for Android devices.

For a marketing campaign to be successful, it must reach the right audiences. For companies marketing to sports enthusiasts, understanding the Nike target audience is a big step in fine-tuning campaign messaging and targeting to get the best results.

For these kinds of data-driven insights for Sports Enthusiasts, Runners, and 500+ other consumer segments and audience locations around the world, visit the Consumer Insights and Audiences Hub.

Nike FAQs

What demographic buys the most sneakers?

Data shows that the target market for Nike shoes includes Millennials (24–39-year-olds) and Gen Z (9–24-year-olds). Presumably, many Millennials are buying sneakers for their young children. Men still buy more sneakers than women, but the gap is closing.

What demographic buys the most Nike products?

Consumers between the ages of 15-40 buy the most Nike products, including sneakers, apparel, and sporting goods.

Who is Nike's competition?

Nike’s biggest competitor is Adidas, but others include Asics, Puna, Under Armour, Fila, New Balance, and Sketchers. In terms of athletic apparel, Nike’s competition includes Lululemon, Athletica, and VF Corporation.

Who makes more sales Nike or Adidas?

Nike generates more sales than Adidas. In 2020, Nike was valued at $34.4 billion, while Adidas was valued at $12.07 billion.

How to define the year that was 2021: Corona Light? The year we learned to live with COVID? The second year of the pandemic?

Whichever name you prefer, it is clear that 2021 was a kind of transition year. The initial shock of the pandemic gave way to a hybrid blend of ‘normal’ life and social distancing. Once again, there was a shift in consumer behavior and this is reflected in Start.io mobile audience data, covering hundreds of consumer segments and the entire globe.

We’ve pinpointed several key segments with notable data shifts that may impact your mobile advertising strategy in 2022. Here are the consumer behavior trends worth keeping an eye on as you kick off a new year and new marketing plan:

Baking and cooking

According to a survey about hobbies during coronavirus, 21% said that they turned to baking in their extra time at home, perhaps because it provides an opportunity to get away from screens and enjoy a wholesome family activity. This is reflected in mobile app usage, with a 16% jump in the usage of baking and cooking related apps in 2021 compared to 2020.

Meditation

The stress of the pandemic has taken its toll. According to the CDC, between August 2020 and February 2021, the US population saw an approximate 5% increase of symptoms of mental health issues (36.4% to 41.5%). It’s no wonder that people are turning to apps and tools to help improve their state of mind. This year saw an increase of 30% in use of meditation apps, definitely pointing to the need among global audiences.

DIY

DIY saw a huge boom during the pandemic, with 25% of DIY fans saying this was due to “finally having the time for it”. This is reflected in mobile audience data too, with a doubling of the number of users interested in DIY apps, from 4% to 8%. With more time at home, and more free time on their hands, DIYers have been taking advantage and will continue to do so as long as it is convenient.

News

After two years of non-stop pandemic news, you might think that people are feeling “news fatigue”, but actually more people are using apps to get their news than ever before. In 2021, there was an increase in 12% of news app usage, showing that people simply can’t get enough of the news and staying connected to what’s going on is still vitally important.

Dating

COVID rules made dating very difficult. In fact, the post-pandemic world has given rise to a new trend: FODA, or fear of dating again! Even so, there’s no stopping love, and dating apps are seeing an uptick, with an overall increase of 30% in usage, from 18% in 2020 to 24% in 2021.

Careers and employment

The Great Resignation is well underway, and people are changing jobs or considering a change in higher numbers than ever before. This is reflected in mobile app usage around careers and employment, with a 27% jump (from 9% in 2020 to 11% in 2021), as people use this time to re-think their aspirations and shift their career path.

Wedding planning

Weddings took a big hit during the pandemic. In spring 2021, it was reported that 7000 weddings in England were being cancelled due to confusion surrounding lockdowns and social distancing rules. As the world opens up, couples don’t want to wait any more, and this can be seen in the 57% increase in usage of wedding related apps in 2021 compared to 2020.

VPN

Work from home was a key characteristic in 2020, and it continued big time into 2021. This was noted in mobile audience data that showed a 101% increase in VPN use, jumping from 17% in 2020 to 35% in 2021. Expect this to continue into 2022, as 61% of remote workers say they will be working in hybrid mode in the future, with 27% saying they will work from home full time.

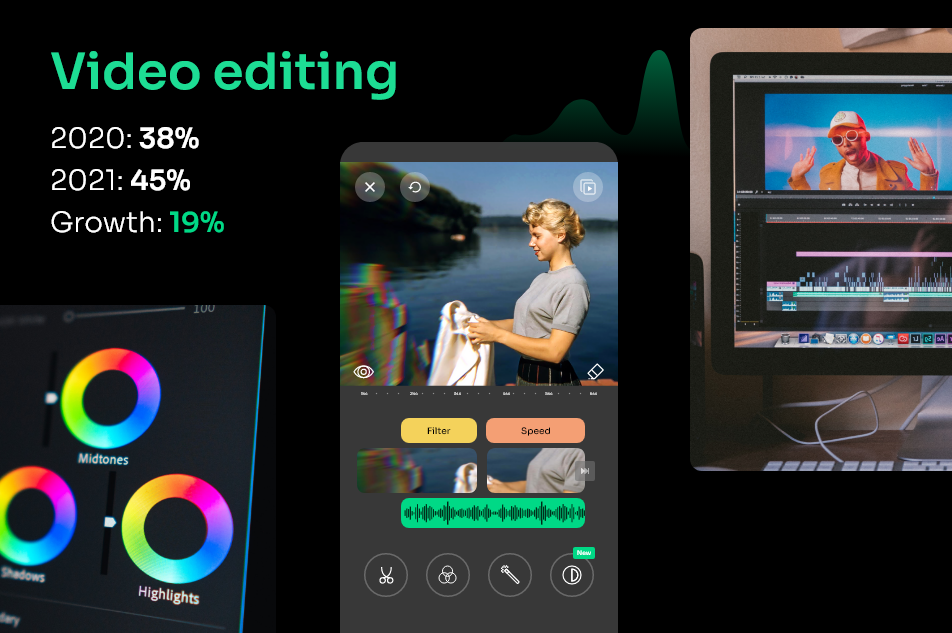

Video editing

With more work from home, less time spent commuting, and less going out to socialize and for leisure, people are turning to other creative outlets and interests, especially those that can be done at home and on computer. Video editing was a big one this past year, with a 19% increase of mobile audience interest, from 38% in 2020 to 45% in 2021.

Mobile audience data: the key to success in 2022

Mobile app usage is on the rise, and during the pandemic, it was nothing less than a boom. In the business segment, for instance, there was a 220% increase in app usage. The tricky part is getting behind these awesome numbers to analyze the trends and understand what’s really going on across all consumer segments. In light of this, what will the new year look like for mobile users and marketers?

2022 kicked off with the Omicron variant raging around the world, governments working hard to increase vaccination rates, some countries returning to lockdowns, continued social distancing, and a lot of uncertainty among consumers about how to behave. This kind of confusion can expect to give rise to continued use of mobile apps in most segments.

On the other hand, many consumers are experiencing “pandemic fatigue”, with a longing to return to in-person shopping, gym visits, working at the office rather than at home, concerts, vacations, leisure experiences and more. It is clear that 2022 is not simply a case of “2020-too”, but rather the beginning of the return to pre-pandemic life, intertwined with the deeply ingrained, new habits of a hybrid lifestyle that blends online and offline experiences like never before.

With the help of Start.io data gathered from half a million integrated apps and 30 billion SDK downloads, you can gain accurate, powerful insights about audience behavior and drive smarter mobile advertising in 2022. To dig deep into mobile data for your target audience, in hundreds of consumer segments and locations, visit the Start.io Audience hub, or read our recent blog post on Demographic Audience Analysis.

Food. It’s no longer just a source of fuel and nutrition for the body. In recent years, it has become a powerful and competitive consumer segment.

In 2019, a US study found that over 50% of consumers considered themselves “foodies”. More than 60% said they would go to an event just for the food, and 26% had shared a food snapshot on social media in the previous month.

There are entire communities of foodies all over the world who are thinking about food, preparing food, browsing online and offline for food and related items, cooking at home, or dining out. In this blog, we’re going to explore home delivery food trends, what that means for food businesses, and how mobile user data can illuminate food delivery app customer segmentation and advertising strategies for marketers and app publishers in the niche.

The rise of food delivery apps

When COVID hit, the food industry was faced with a dilemma and a challenge.

On the one hand, restaurants had to comply with lockdown orders and social distancing rules, and that meant a severe drop in business. On the other hand, consumers were more focused on food than ever – they became more interested in the kitchen and home cooking, and increased their takeaway purchases too.

These changes to online food ordering trends are so far here to stay. In fact, one in five survey respondents say they are enjoying more takeaway food now than before the pandemic.

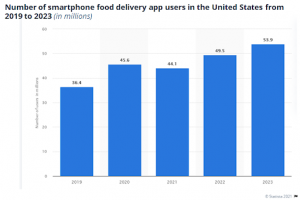

In all these rapidly changing trends and habits, food companies have had to adapt quickly, and restaurants in particular are looking for ways to bounce back and restore their business activity to pre-pandemic levels. One way to catch audience attention and boost restaurant orders is with food delivery apps, which are steadily growing in popularity as the graph below clearly shows.

Food delivery app users: No longer just a niche segment

Food delivery apps were once a niche market, mainly serving the more mobile-savvy and tech-native Gen Z and millennials. However, when faced with lockdowns, restaurants all over the world took to food delivery apps as a way to grab the target audience’s attention, continue to serve customers and increase business opportunities.

This is evident in the success of Uber Eats, an offshoot of the ride-sharing company. During shelter-in-place orders, when ride sharing demand was way down, Uber Eats generated $4.8 billion in revenue from food deliveries, representing over 40% of Uber’s business.

Another way that restaurants have been innovating during this time is the establishment of “ghost kitchens” – kitchens set up for the sole purpose of food delivery, with no in-house restaurant seating. Ghost kitchens are an excellent solution, but they are costly to run, and they come with critical issues of operational viability and scalability.

Before investing in a ghost kitchen, business owners must ask themselves, where is the best location that will serve the largest number of consumers? Where are the foodies located, what kind of service are they looking for, and how can my business provide it? Read on to see how Start.io data insights can help food delivery companies answer these questions.

Foodies in Boston vs LA: A Start.io case study

Analysis of Start.io data in Boston and Los Angeles helps paint an accurate picture of the characteristics and behaviors of local foodies.

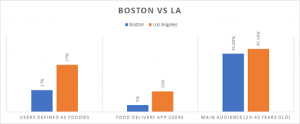

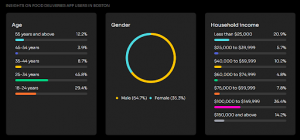

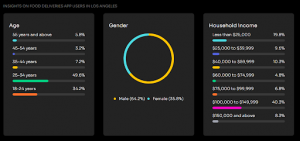

Both cities are home to big communities of foodies, who love dining out and in, however Los Angeles is the definite leader, with 37% of mobile users defined as foodies in LA, compared to 17% foodies in Boston. This is reflected in the activity seen on food delivery apps too. In LA, 16% of users actively order food via their mobile devices, with just 5% doing the same in Boston.

There are similarities between the cities too. In both Boston and LA, affluent consumers are the ones who most use food delivery apps, with over 50% earning $75K or more annually. The younger adult age group of 25-34 year olds is by far the biggest audience, with 49.06% in LA and 45.08% in Boston, and in both cities, men are the majority of food app users, with just over 64% user share.

Interestingly, despite that LA is a more food app-centric market overall, there are in fact over 20,000 mobile users displaying the potential to become food delivery app users in Boston.

What’s next for food delivery app publishers?

The global pandemic of 2020 continues to reverberate its impact on businesses, and for food providers, it has been a game changer. As time passes, people become even more accustomed to the convenience and speed of food delivery apps and home delivery trends continue. Having a grasp of up-to-date consumer data for this user segment is crucial to know what steps to take next.

For example, according to Start.io data in the US, the majority of food delivery app customer segmentation is young millennials with a strong male majority. This audience is tech savvy and fast to adapt to market and technology changes. They are also impatient, and interested in new innovations.

In addition, the past year has seen constant growth in food delivery app users over the age of 40. With the right marketing messaging and effective targeting, food app publishers can reach this growing audience and leverage a valuable potential revenue stream.

Online food ordering trends: All you need to know

This Start.io data, and more like it, is a powerful way for food businesses and restaurant owners to identify the best target audience for food delivery in different locations. Then, they can make more accurate and financially viable decisions about things like ghost kitchen set-up and food delivery operations.

With the launch of the Start.io Audience Segments hub, insights like these are available for 500+ consumer segments in every niche, from food to finance, travel to teens, beauty shoppers to burger lovers. This up-to-date mobile user data covering hundreds of locations worldwide, accessible instantly via a simple search console.

Be sure to check in to Start.io Audiences Hub and start taking advantage of data to boost your performance in the food delivery app and online food ordering segment.

For advertisers in the mobile ecosystem, there’s no such thing as “too much” audience data.

Data-based insights about the behavior and interests of the target audience is always the key to effective ad campaigns. It is also what you need in order to focus budgets on the right consumers at the right place and time. But the more data you have, the harder it can be to separate the wheat from the chaff, and find the nuggets that will really have the impact you need for campaign performance.

That’s the motivation behind our Audience Segments hub, where you can discover up-to-date data insights about mobile users among dozens of consumer segments, in hundreds of cities, states and countries, worldwide. Read our latest blog posts about Nike Target market analysis and Tesla Target market analysis to learn more about these insights.

The Start.io network is constantly gathering mobile user data in real-time, all over the world. This massive pool of valuable data provides a real-time “snapshot” of what consumers are doing, where they are shopping, what they like to buy, what mobile device and carrier they use, and more. And all those insights are now available to Start.io advertisers, with just a click of a button.

Audience Segment Data: It’s Totally Up to You

Our Audience Segments page is designed to provide you with easy access to a vast range of data sorted according to consumer segments, so you can pick and choose the ones most relevant to your business. Plus, you can narrow down your data results according to location, so you can explore what’s happening on the ground, right now, among your target audience.

Use this information to craft accurate and effective mobile ad campaigns for specific user segments and locations. And the best part of the Audience Segments hub? It’s completely up to you. Start.io’s Audience Segments hub provides 30 different types of audience segmentations, divided into different states, countries, and cities across the world – you do the math.

Coffee Enthusiasts in Cleveland, Job Seekers in Jakarta, New Parents in New York – with a wide array of niches and global locations, the possibilities are endless. Simply select your relevant segment, choose the location, and explore the data.

But that’s just the beginning, and just a drop in the sea of the Start.io data available to advertisers. At the Audience Segments hub, advertisers can browse the audience segments by category and location, at no cost. Then, take the process to the next level by contacting Start.io and activating the chosen audiences in mobile campaigns.

Case in point: Father’s Day Approaching…

We invite you to leverage Audience Segments for general ad campaigns or access the data to help you create specialized campaigns for seasonal marketing and upcoming holidays. With Father’s Day approaching, for example, Start.io advertisers are diving into Audience Segment data to target potential mobile audiences likely to be browsing and shopping for Father’s Day gifts.

For instance, the audience segment of Car Owners, a much-loved topic among dads everywhere, has a massive potential audience of 168 million mobile users worldwide who own or intend to own a car.

The audience segment of Fitness Enthusiasts is made up of 64 million mobile users, offering rich opportunities for fitness brands to target relevant users with Father’s Day promotions around health, sport and fitness.

Let’s take a closer look at the Car Owners audience segment in India, numbering over 28 million mobile users. This audience is more than two-thirds male, with nearly 60% in the 25-44 age bracket. The data has identified a huge segment of consumers who are both interested in cars, and likely to be celebrating Father’s Day with their families.

For advertisers of auto and related products in India, this is a prime audience for targeting with relevant mobile ads in the leadup to Father’s Day. And thanks to Start.io Audience Segments data, advertisers can now explore and activate this audience to get more from their Father’s Day mobile ad campaigns.

These are just a few examples of the specific audience segments that can be targeted from among Start.io’s vast global base of mobile users and 1 million integrated apps.

For your next mobile ad campaign, check out Audience Segments first. You’ll be amazed by the power of Start.io to select the exact data insights you need to optimize your mobile marketing activity – what you need, when you need it, with just a few clicks. Try it!

For more info on marketing plan for 2022 read our year-in-review blog post.

GameStop’s Stock Fluctuation

Looking at 12 months of data from Start.io indicates that GameStop’s stock fluctuation has little to do with its revenue and overall health, which has seen rises and falls in foot traffic more closely correlated with the COVID pandemic.

The everyday investor follows company financial reports and official statements to evaluate the stock price versus the current performance and outlook. High-end financial market players are using real-time business insight tools to better assess their portfolio’s business outcomes.

Given the fact that the last quarterly report of GameStop was released on December 8, 2020 and the full annual report was on March 27 2020, very early in the pandemic, it’s quite challenging to find any evidence that would show an economic factor supporting a clear investment decision right before the explosion.

The last few weeks have sent GameStop’s stock on a turbulent roller-coaster ride, with severe peaks and equally dramatic drops. Looking at 12 months of data from Start.io indicates that the company’s stock fluctuation has little to do with its performance, which has seen rises and falls in foot traffic more closely correlated with the COVID pandemic and may be influenced by the trend of moving to e-commerce.

Robinhood’s army that makes investments with the tips of their fingers are probably the same ones that are shifting to a fully online shopping experience.

GameStop Data Tells A Different Story

GameStop has 4,000+ brick and mortar stores spread across the US. To get a clearer picture of GameStop’s actual foot traffic and see if the hype was warranted, Start.io pulled historical data from its mobile data platform.

Below is Start.io’s data that charts the visit trends across all US-based retail stores during the last 12 months. What this shows is that the pandemic has had a tremendous impact on GameStop’s business. There is an upwards trend running from the end of December 2019 through January 2020, presumably due to holiday purchases.

A significant decrease in traffic during March and April corresponds with pandemic-related stay-at-home orders as the virus started to ravage the country. There is a positive trend around June and July, due to many parts of the country opening up again, but the increase didn’t reach earlier numbers.

The fall and winter months display another negative trend that aligns with the later waves of retail being shut down in different US states. Clearly, what has had a real and lasting impact on GameStop is the continuous opening and closing of retail outlets.

There is a significant gap between what happened in the stock market and the reality on the ground. While there are aggressive moves on all fronts with high volatility in the stock market, the retail stores have been directly impacted by the pandemic yet are still attracting customers and traffic, not shutting their doors. As to whether GameStop’s stock is a strong investment opportunity, only time will tell.

Disclaimer: The information contained in this review is not intended as, and shall not be understood or construed as, an advice, analysis, recommendation, professional review or otherwise with respect to GameStop, including its performance, financials or securities, nor shall it be used for such purpose.

Start.io is not a broker or a dealer, nor an investment advisor, and does not have any access to non-public information about publicly traded companies, and this review is not a place for the giving or receiving of financial advice, advice concerning investment decisions or tax or legal advice.

This review is based on Start.io’s internal analysis of data available to Start.io throughout its medias and data platform. Start.io does not guaranty for the accuracy of this data.